A Benchmark for the Carbon Tax, no Benchmark for cheap electricity

As part of a comprehensive policy package, carbon taxes will have a central role in guiding the energy transition by providing the economic incentive to switch from high-carbon to low- or zero-carbon technologies and products. In Ireland, the Climate Change Advisory Council has recommended a phased increase in the carbon tax from the current €20 per tonne to €80 per tonne by 2030. In terms of benchmarking, it is worth noting that some countries already have carbon taxes at the upper end or even in excess of this range, with the Swedish carbon tax currently at $139 (e112) and Switzerland at $101 (e81).

The Central Bank have now thrown their weight behind the sudden political push for an increase of the carbon tax in Ireland. Their recent report about climate change and it's alleged impacts on the economy fail to address the issue of the unsustainable levels of government and private debt in Ireland, which allow us to live far beyond our means and consume resources at a far greater rate than previous generations. There is no mention of unsustainable government spending and the bloated welfare state (The cost for a new hospital in Dublin has risen from €400m to nearly €2bn, welfare spending still stands at €20bn despite lowest unemployment for over a decade).

The Central Bank fails to understand that emissions are coupled with economic growth so that if climate change were really having an impact on the economy, we would be seeing economic decline right now, followed by a consequent reduction in emissions. They make the observation that 1991-2016 temperatures were higher than the period for 1960-1990, which actually supports the natural cyclical theory of climate change rather than the man made theory. They also claim that insurance payouts due to extreme weather events are up. The 1940s were perhaps the worst decade for flooding and crop devastation in recent history but I can find no evidence that there were any insurance payouts at all. But I want to focus on one particular part of their report, the carbon tax.

The purpose of the Central Bank presentation on climate change appears to be to groom Irish people for more taxes, specifically carbon taxes.

They present Sweden and Switzerland as models for Ireland to follow in this regard. What they fail to state is that Sweden has electricity prices at least 25% less than Ireland. But more importantly, Switzerland, which has a carbon tax equal to that proposed by Irish politicians, has had one of the lowest electricity prices in the world for many years, roughly half that of Ireland, which now ranks as one of the most expensive countries for electricity in the world. Switzerland generates most of it's electricity from hydro and nuclear (as does Sweden). How is it that Ireland's indigenous wind industry cannot compete with Swiss hydro, an indigenous renewable source that does not lead to high Swiss electricity bills ?

The examples of Sweden and Switzerland actually undermine the central banks case for more carbon taxes in Ireland as it shows that we are already paying comparatively much higher for energy. A carbon tax similar to what was introduced into these countries could make Ireland the most uncompetitive country in the world for energy with actual knock on impacts for our economy far worse than "climate change".

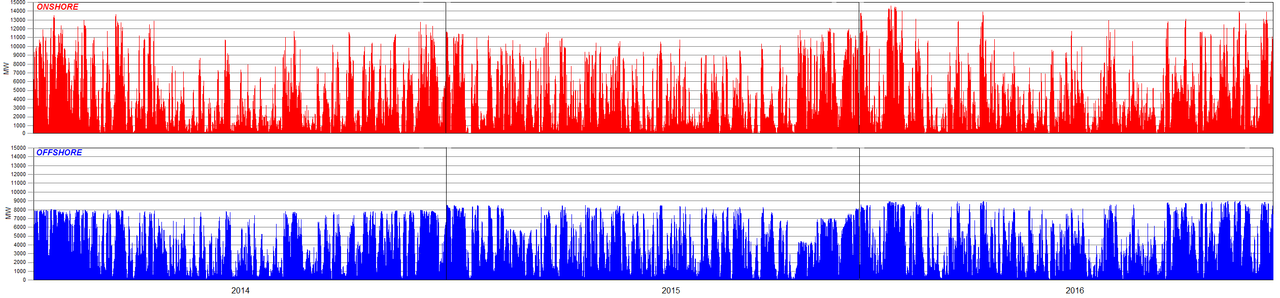

One could have perhaps made a better case for the carbon tax if wind energy had led to the cheap energy revolution that Irish people were promised. But as we all know that never materialized.

|

| https://ec.europa.eu/eurostat/web/products-eurostat-news/-/DDN-20180807-1 |