One and one equals two, six less four equals two, four by three equals twelve - can you do the maths ?

"To think that two and two are four, and neither five nor three, the heart of man hath long been sore, and long tis like to be" - A.E. Housman

Critics of Irish wind energy have got their sums wrong - Irish Times

So lets see who has the deficiency in mathematics.

The reason is not wind but rather the cost of importing gas.

The problem is that more than half of Ireland’s electricity is generated from gas – the fourth highest share in the EU – leaving us more exposed than other countries to gas price increases. When gas prices increase, electricity prices here increase more, and Ireland’s competitiveness declines.

Wind replaces more expensive generation options, reducing their operational and fuel costs. The final net impact on consumer bills is minimal.

The Academy of Engineering point out the fuel price differentials in their July 2014 report :

SEAI’s recently published analysis of the” Benefits of RenewableElectricity in 2012” indicates that in the Republic of Ireland the 4.09 TWh of wind generation is estimated to have saved €177 million in fossil fuel imports i.e. €43.2 per MWh and reduced CO2 emissions by 0.37 tonnes per MWh - indicating that wind almost exclusively displaced highly efficient gas-fired CCGT generation. Wind generators received in excess of €80 per MWh for wind output in 2012. This means that wind generation added almost €40 per MWh to the electricity sector cost base in 2013 i.e. €165 million. This does not include the impact of wind-related transmission cost increases or system operation cost increases.

Simple Maths Sum # 1

Cost of gas --- € 43 per MWh

Cost of wind --- € 80 per MWh

Difference --- € 37 per MWh --- which is the additional amount we must pay when wind displaces gas

Cost of gas --- € 43 per MWh

Cost of wind --- € 80 per MWh

Difference --- € 37 per MWh --- which is the additional amount we must pay when wind displaces gas

The reason is not wind but rather the cost of importing gas. Between the summers of 2009 and 2013 wholesale gas prices almost doubled across the EU. Analysis by the International Gas Union shows that between 2007 and 2013 prices increased consistently in all regions except North America.

2009 was the last time a crash occurred in oil and gas prices. So obviously prices increased after that.

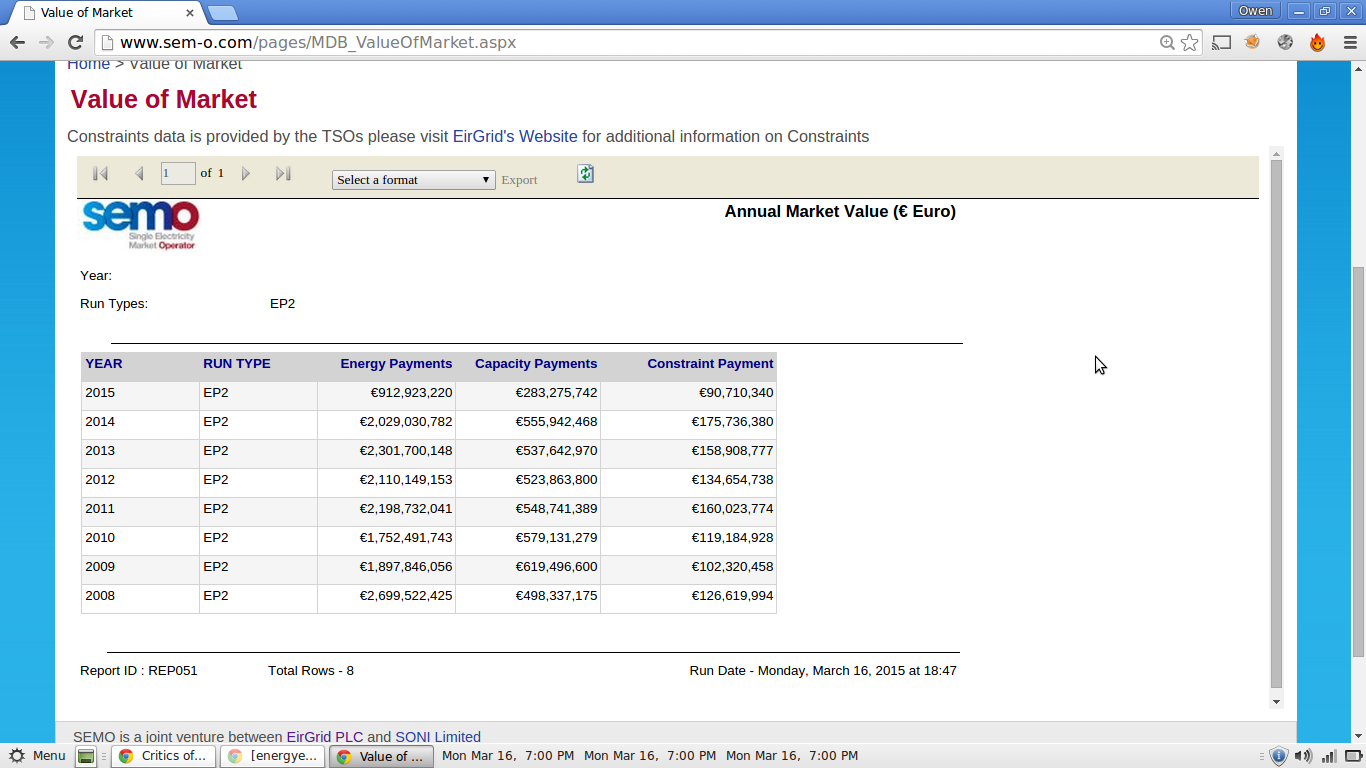

So gas (and oil) prices hit a peak in 2008. There then was a dip in 2009 and a slight rise after that. This is reflected in the Annual Energy Payments (The market price per MW sold per half hour) below provided by SEMO :

As you can see Energy Payments, which are a direct reflection of wholesale prices, hit a peak in 2008 of € 2.7 billion and have not come anywhere close since. So our electricity bills should have come down since then by Mr Curtin's logic. But instead our bills have gone back up again and now exceed 2008 prices :

|

Lets look at the electricity bills in 2014. Have they come down yet ? Do you know how numeracy works - € 24.05 (2014) is greater than € 20.33 (2008) i.e. electricity was more expensive in 2014 than 2008 , but Energy Payments were higher in 2008 (€2.7bn) compared to 2014 (€ 2bn) (click on each table to zoom in) so the bills should have come down by Mr Curtin's calculations.

|

| From SEAI |

|

| From SEAI |

Well, the answer is we are in the middle of an energy bubble that is really indefensible :

http://irishenergyblog.blogspot.ie/2015/01/energy-bub.html

All this additional capacity must be financed through electricity bills, whether that capacity is used or not. Excess capacity is financed through capacity payments and the PSO Levy. Most of this excess capacity is due to the € 4 billion investment in wind generation - it's not an anti-wind position to state this, it's simply a statement of fact.

Another factor is Ireland’s lower population density. We need about 70 per cent more metres of cables per person than the average, which feeds into higher prices.

This was always the case in Ireland. As can be seen from the below graph, it didn't prevent Ireland from having a very competitive electricity price during the 90s before they started this renewable gig :

In 2015 electricity prices will decline further, driven again by lower forward gas prices. The correlation is as clear as day.Has anyone seen these lower electricity prices ? Last time I checked my bill the PSO Levy was going up once again. Can anyone find one of these bills with lower prices ? Please do let me know.

The situation is exacerbated by the fact that Ireland must import its gas from the UK through interconnectors, and Irish consumers bear this additional cost.Funny then that we once had lower electricity prices that the UK during the 90s when we still were reliant on UK fuel imports :

Others have identified “hidden” network costs they argue are necessary to facilitate wind. It is true that Ireland is currently modernising an electricity network that for many years suffered from chronic underinvestment. Current investments also support traditional generation, increased demand in the regions, and indeed a more responsive, intelligent and modern grid generally.It is now accepted by almost everyone that Grid 25 is required to facilitate renewables, including Eirgrid :

The implementation of GRID25 is essential if Ireland is going to meet its targets for generating electricity from renewable sources (link).

Next we are told:

Current investments also support increased demand in the regions

Current investments also support traditional generation

Current investments in the grid have nothing whatsoever got to do with traditional generation. This shows a very poor misunderstanding of how power generation and grid infrastructure works. Traditionally, power stations were placed close to towns and areas of large population. The grid infrastructure was larger at the power stations and towns and then progressively smaller as it reached remote regions. With the advent of wind generation, grid infrastructure now has to be built inversely i.e. larger cables in remote locations are required to bring the energy to the towns and cities.

There are also other hidden costs which are directly attributable to wind such as constraints payments for conventional plant which I have written about here :

http://irishenergyblog.blogspot.ie/2014/12/whats-in-electricity-bill-part-2.html

You can see that they have risen every year since 2010 as wind penetrations got higher and the smooth running of plant got ever more interrupted. The Energy Regulator accepts that "More and more wind on the system adds extra costs."

Total investment in wind will reach €3.5 billion by 2020. This is a frightening number, leading several commentators to make the simplistic assumption that consumers will have to foot this bill.

Simple Maths Sum # 2

4,094MW onshore @ € 2 million per MW = € 8.1 billion

555MW offshore @ € 3 million per MW = € 1.6 billion

Total investment = € 9.7 billion not € 3.5 billion

External Sources for these figures can be found on this blog

http://irishenergyblog.blogspot.ie/2015/02/20-billion-committed-under-irelands.html

and this one

http://irishenergyblog.blogspot.ie/2015/02/cost-of-renewables-infrastructure-in.html

4,094MW onshore @ € 2 million per MW = € 8.1 billion

555MW offshore @ € 3 million per MW = € 1.6 billion

Total investment = € 9.7 billion not € 3.5 billion

External Sources for these figures can be found on this blog

http://irishenergyblog.blogspot.ie/2015/02/20-billion-committed-under-irelands.html

and this one

http://irishenergyblog.blogspot.ie/2015/02/cost-of-renewables-infrastructure-in.html

Since we are engaging in simplistic argument, it is not the Irish consumer but the king of Norway who will pay. We import the largest proportion of our gas from Norway, and investment in wind will reduce coal and gas imports by nearly €300 million per annum by 2020. Consumers will benefit by not having to pay for these imports.

Why deal with simplistic arguments when one can actually look at the detail ? Could it be that simplistic argument is the coinage for a propaganda machine ? Dr Fred Udo has done an analysis using SEAI and Eirgrid data and found that running our CCGT in an efficient way would save more fuel than the investment in wind did.

http://irishenergyblog.blogspot.ie/2015/03/wind-turbine-build-outs-and-co2.html

That's right, using modern CCGT in an efficient way saves fuel - thats the rationale behind using fuel efficient generators whether its the engine in your car or the generator in a power plant. The King of Norway in no way feels threatened by 13th century technology. In fact, wind power is very reliant on gas for its own house load needs.

http://irishenergyblog.blogspot.ie/2015/03/wind-turbine-build-outs-and-co2.html

That's right, using modern CCGT in an efficient way saves fuel - thats the rationale behind using fuel efficient generators whether its the engine in your car or the generator in a power plant. The King of Norway in no way feels threatened by 13th century technology. In fact, wind power is very reliant on gas for its own house load needs.

The deployment of wind creates economic growth in Ireland and investing in Irish wind instead of Norwegian gas boosts activity in the local economy. Analysis suggests that GDP would be boosted by €500 million per annum by 2020, creating thousands of jobs in the process.

Airtricity operate 25% of Irish wind farms - owned by SSE, a British company

Energia operate 25% of Irish wind farms - owned by Veridian plc, a British company which is ultimately owned by Arcapita Bank based in Georgia, USA.

Bord Gais operate 15% of Irish wind farms - owned by Centrica plc, a British company. It was rumoured in July last year that Qatar were attempting to buy a large stake in the company.

____________________________________________________________________

Fantastic rebuttal.

ReplyDeleteHow do we stop this madness?

ReplyDeleteIf wind saves some fuel and co2 emissions at low portions of the system (as the ESB stated in 2004 but which I doubt,) and the saving decreases incrementally tending towards zero (ESB report 2004, Impact of wind), then is it not reasonable to suggest that the contribution eventually becomes negative and wind uses more fuel than if were not there at all.? pages 23 and 24. paragraph 2 http://www.eirgrid.com/media/2004%20wind%20impact%20report%20%28for%20updated%202007%20report,%20see%20above%29.pdf

ReplyDeleteLet's debunk this nonsense by the Academy of Engineering here. They mention fuel savings and forget the carbon tax on this fuel. But they also forget wearing and maintenance of gas power plants, and of course the profit for the supplier. This is all mirrored in the wholesale prices . Surprisingly enough, the number of "€ 80 MWh" is pulled out of thin air. The cap price for wind was between €68 to €70 for that period, the very same as the wholesale price. Wind is getting the lowest REFIT of all renewables.

ReplyDeleteTherefore, wind energy is not more expensive than other sources of electricity, and Irish subsidies for wind energy are negligible.

http://www.dcenr.gov.ie/NR/rdonlyres/DE1D5347-BA66-452C-B9B0-5FF7A7835503/0/ReferencePricesforREFITSchemes.pdf

http://www.bordgais.ie/annualreport2012/images/energygraph6.jpg

https://sites.google.com/site/keepirelandfrackingfree/EU%20share%20of%20RES-E%20levies%20in%20the%20electricity%20price%20for%20households%20by%20country.jpg

First of all, there must be a difference in price between wind (and peat) and other sources by the very virtue of the fact that the PSO Levy exists. The purpose of PSO is to bring a low wholesale price (for every generator) up to a higher fixed price (for wind / peat). So wind must be getting higher than gas. The question then is what is the difference. This paper backs up the Academy's figure of € 80 MWh as you need to include the balancing payment of €9.90:

Deletehttp://mnag.ie/wp-content/uploads/2012/10/Power-Purchase-Agreements.pdf

"REFIT reference price plus balancing payment: €80/MWh"

"For large wind, means SEM price needs to be above €77.98 for chance

to beat REFIT rate, i.e. “upside”

The wholesale price usually reflects the price of gas. Recently this was about € 50 MWh :

http://irishenergyblog.blogspot.ie/2015/05/does-wind-energy-reduce-wholesale-prices.html

So at the moment the subisdy to wind farmers is worth approx € 30 MWh, not too "negligible".

This comment has been removed by the author.

DeleteBalancing payment is not always paid and not always in full. You would need to provide data that would justify your €77.98 per MWh. Wholesale prices in 2012 were between €60 and €70 per MWh, the period your article refers to.

DeleteIrish subsidies are very little (negligible) in return for carbon emission reductions and price stability. REFIT is predictable, fuel prices are not.

https://sites.google.com/site/keepirelandfrackingfree/EU%20share%20of%20RES-E%20levies%20in%20the%20electricity%20price%20for%20households%20by%20country.jpg

Note: Not even a quarter of the PSO is paying for wind. The bulk is still going to dirty peat. Wind power is actually lowering wholesale prices on the market. In 2011 wind was offsetting its PSO and the dispatch constraint costs.

BTW, Admin. Do you have a name?

How can the carbon tax on the fuel used to generate electricity mean wind energy is cheaper? Is it not the case that fossil fuel generation is essential in a system with wind in it? Wind does not displace base load plant accounting for 46% of demand and wind cannot be allowed in above 50% of demand. (Eirgrid's website). Wind cannot be used alone. Is not some of the carbon tax on fuel handed to wind generators? Its a bit like if a passenger takes a taxi and after getting paid, the driver is legally obliged to refund the price of the petrol to run the car on the trip. Mad.

ReplyDelete