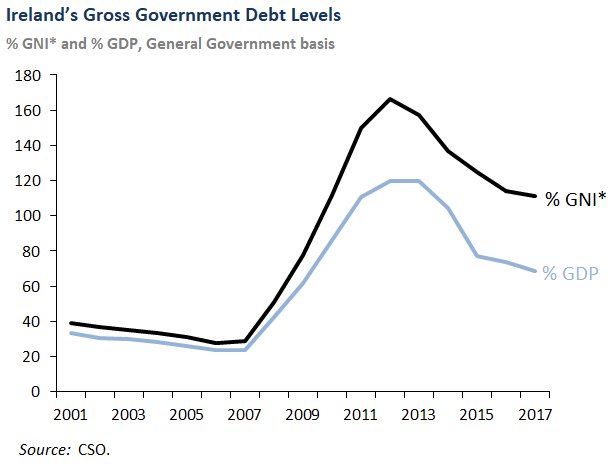

Ireland's debt burden is understated by standard GDP comparisons. Using adjusted Gross National Income (GNI*), which adjusts GDP for the impact of foreign multinationals who book their large non Irish profits here, our debt burden remains high at 111% for 2017. Our government still runs up deficits each year adding to this debt. Government spending is still out of control.

Ireland's unemployment rate in 2012 was 16%, it is now at 6%, a fall of 62%. Yet, social welfare payments (excluding pensions) have only fallen by €2 billion, from € 14.5bn to € 12.5bn, a fall of just 14%. How can this be justified?

Our EU contribution has doubled since 2012 to €2.6bn. Our already bloated health sector, one of the most well funded in Europe, has had an increase of €1 billion in it's budget. The funding for housing has more than doubled to €3.3 billion. Superannuation and retired allowances have increased by €50m to €570m. Foreign Aid spending has increased by €40 million to €500m. Spending on public broadcasting has also increased, now reaching € 255 million.

This level of debt and spending is clearly unsustainable and allows us basically to consume resources beyond our means - the very definition of unsustainability. Yet many politicians from all sides want to increase spending and debt further, whether it's hikes in public sector pay or bringing in more migrants who require public housing and medical services.

This should be target number one on the list for groups like the Citizen's Assembly. But of course it doesn't even feature in climate change discussions as climate policy is just another justification for more spending, more taxation and more debt.

1) https://whereyourmoneygoes.gov.ie/en/

2) Unemployment rate was 5.8% in may 2018. population increased by about 4% since 2011, according to CSO.

It is indeed difficult to reconcile sustainability in any context in this era of instant gratification rampant consumerism. It is interesting that the cost of debt servicing and EU payments shown in the link to this post ranks third after social protection and health. It is possible that a parallel can be drawn with personal discretionary debt servicing and spending, as societal trends tend to correlate with individual behaviour in a democracy. The lessons of Lehman Brothers seem to have fallen by the wayside. As such, it is no wonder that the Central Bank reports that elderly people are boosting their savings to the detriment of the overall economy. It is hard to be economically rational when you can see the train crash coming down the line.

ReplyDeleteIf we look at the roll of government in most western countries through a different set of binoculars, we might consider this as being true. The real roll has always been and is now and will continue until stopped as follows:

ReplyDelete1) It is to promote wealth creation by its citizens, funding growth, jobs and better services in the short term. The effects encourage their re-election.

2) The wealth of the country from its citizens hard work and thrift is measured to assess when the citizens have enough.

3) When that assessment determines that the citizen has enough and the politicians have acquired enough wealth for themselves, a process is begun to take that wealth from citizens and give it to someone else who is not entitled to it.

4) Ireland has many examples. The Celtic Tiger banking building boom being one, the current renewable energy racket being another.

5) Climate change being another.

A common feature is that someone other then the person who earned the wealth gets to benefit from it. They are usually (but not always) failed people. A few may be already rich. Some may be migrants with nothing much in their possession.

Once this factor is identified, everything else becomes clear. About 25 years ago Ireland created a National Pension Reserve find and it built up until 2008 when part of it was wasted paying off non sovereign bank loans and the rest (92) million was thrown into Renewable Energy Company Gaelectric which is now failed. This is happening again with the strategic fund which pouring it into buying failed wind farms.

Sounds like that strategic reserve is running a bit low. Philip Lane, Governor of the Central Bank, has warned that failing to balance the budget has left us less well able to manage the next downturn. The Irish Times (27 July) reports that he told the Magill Summer School that: “The Government really should be running a surplus at this point.”

DeleteAll this begs the question of where the funds to pay the pensions of the present middle aged people can come from? It can only come from current tax collection, because it is obvious that any pension reserve fund will be pumped into renewable energy. The Open Hydro company which was to install tidal electricity generators has gone into liquidation. Added this to Gaelectric, Coilte and Element power it provides proof that renewables don't work. Government will soon face a choice of letting its 2,900 MW of wind farms go into bankruptcy or take them over. They will nationalize them which will be the reverse of the privatization drive of recent years. It will take a lot of growth to keep the show on the road.

ReplyDeleteLeo is probably stupid enough to nationalize annual trading looses of 1 billion euro. With asset valuation writedownds of 1.5 to 2 billion euro. That will really bust the budget. It will probably be an order from Herr drunker unt Frau Merkel that initiate the process. It is called being a good European . Solidarity with the German people and their heroic struggle to commit economic suicide . As if we have not . With the governor of the Central Bank knowingly looking on.

ReplyDelete